There are a few things that you can do to make sure that your crypto investments are safe. These include using a good cryptocurrency trading bot and understanding how to apply risk management techniques in the volatile world of cryptocurrencies.

Among them is analyzing the trading volume of a coin over a certain period of time to determine when it’s likely to move in the right direction. This is important because it provides a clear indication of the current market sentiment and whether investors are optimistic or pessimistic about a digital asset’s price.

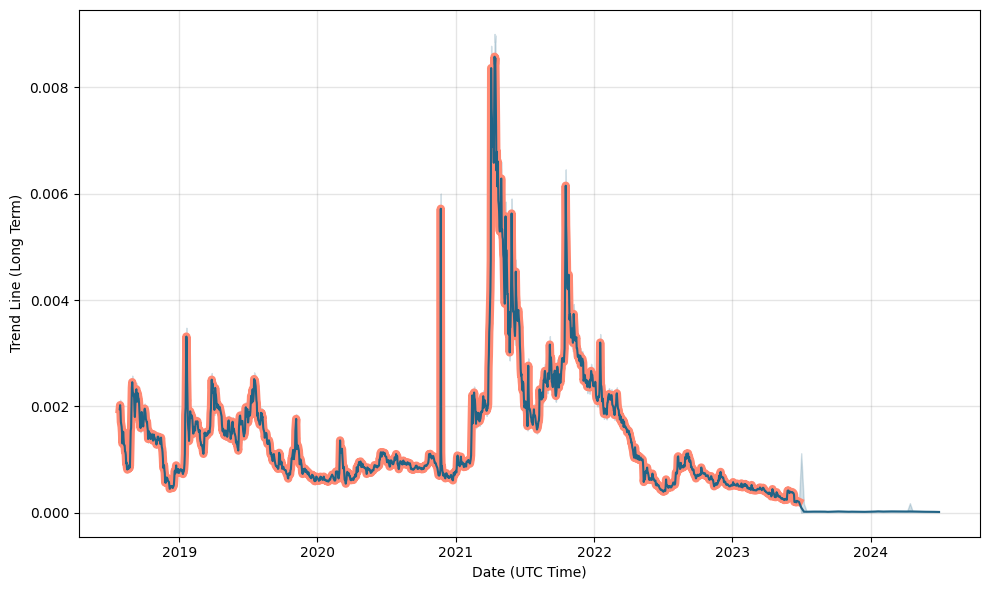

Celsius coin price prediction

Celsius is a crypto asset that is based on a blockchain protocol. It is designed to help users earn through marketplace transactions and enables developers to work on smart contracts without human intervention.

The platform is aimed at bringing fair interest, zero fees, and fast transactions to cryptocurrency users. It also offers loans and wallet-style payments.

Celsius has been a popular digital asset since its ICO in 2018. However, the platform has faced a lot of challenges. Among these were bankruptcy and the loss of billions of dollars in assets.

Hodlbot

Hodlbot is a crypto trading bot that allows users to diversify their portfolios across a wide range of digital assets. It helps investors avoid risk by enabling them to hold a certain percentage of different cryptocurrencies at any time, regardless of market conditions.

The service is a great option for traders looking to maximize their returns without having to spend too much time on manual analysis. It offers affordable subscription packages, auto rebalancing, and good security features.

Hodlbot enables traders to create dynamic portfolios using advanced market metrics. It also offers a number of pre-made indices, including a top 10 market cap-weighted index and an entire cryptocurrency index. Traders can also choose a weighting strategy and see how it performed in the past.

Altrady

Altrady is a crypto trading platform that was built to make the lives of traders easier, and their risk smaller. Unlike many of the exchanges out there, it was designed by traders who understand the challenges of retails trading and one-off investors.

It has a wide range of tools that can help you track your trades and analyze their history. It also offers a portfolio dashboard that helps you keep track of all your assets.

In addition to that, Altrady has a News Widget that will keep you up-to-date on all the latest developments in the cryptocurrency industry. It also has a Quick Scan Widget that allows you to set filters by timeframes, growth rates, declines, specific markets and exchanges.

The site also has a Smart Trading feature that can automatically place orders. This includes take profits and trailing stops, which can help you limit losses and maximize your gains in the market.

Shrimpy

Shrimpy is a crypto portfolio management platform that automates trading and provides a safe way to trade cryptocurrency. It supports many exchanges and allows users to backtest strategies.

A free Shrimpy account offers support for a single exchange and wallet, while a premium plan supports multiple accounts and wallets. It also includes an automated portfolio rebalancing strategy and portfolio history backtesting.

The platform uses API keys to connect to a user’s cryptocurrency exchange, allowing it to access and execute trades. It also keeps API keys secure using FIPS 140-2 hardware security modules.

Shrimpy also offers social trading, enabling users to follow the trading of others. However, this feature has been discontinued due to connection issues between linked exchanges.

Can you lose more than you invest in crypto?

One of the main rules that successful investors follow is to only invest what they can afford to lose. This rule applies to any market, but it can be particularly important in volatile markets such as cryptocurrency.

Cryptocurrency is based on speculation and so its price will fluctuate wildly. This is different to company stocks which are backed by a solid business model and are therefore protected by regulatory safeguards.

This means that even if you do the right thing, your investments could go down in value and leave you with nothing. This is why it is essential to take precautions and keep your money safe, such as by storing it in a hardware wallet or cold storage device. This will help you mitigate your losses and maximize your profits.