Cryptocurrency investments come with a high level of risk. It is important to do your own research (DYOR) before making any decisions.

Siacoin prices are expected to increase in the future. The price of this cryptocurrency is projected to reach its maximum value at about $0.005776 in 2025. This is a significant increase from its current value of $0.017.

Cryptocurrency Prices

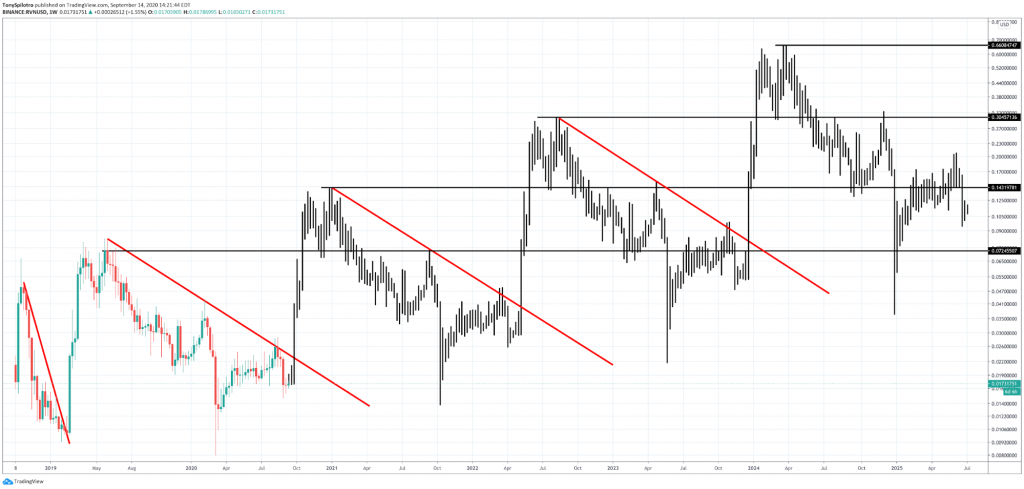

Cryptocurrency prices are constantly fluctuating, and it’s important to know how to read the charts. Traders use tools like moving averages to predict future price movements. These tools give a clear picture of the average price over a specific time period, such as a 12-day period.

In addition to using moving averages, traders also use indicators like RSI and Fibonacci retracement levels to help them make predictions. These tools can help you identify trends in the market and determine whether it’s a good time to buy or sell Siacoin.

Cryptocurrency experts have analyzed the price fluctuations of Siacoin in previous years and predict that the maximum trading price for SC might be $0.0135 this year, while the minimum could be $0.00322. These predictions might change depending on the market conditions. Nevertheless, if the coin can improve its security and expand its user base, it might see a significant increase in price.

GBTC Price Prediction

Siacoin is a cryptocurrency with a very promising future. It has a good use case and has a large community behind it. The team behind the project has been working hard and improving the network. This can boost the token’s value and make it more attractive for investors.

Crypto experts have been analyzing the prices of Siacoin in previous years and have estimated that it might reach a maximum of $$0.029 throughout 2028. The minimum trading cost is expected to be around $$0.024.

Although cryptocurrencies are a risky investment, Siacoin has higher chances of going up than down because it has a strong use case and well-designed tokenomics. Moreover, it has a large community and the company behind the project is solid. So, it’s worth investing in. But remember that you should always research your investments and consult financial advisors before making any decision. This chart contains dummy data, create an account to see real predictions.

Who to Invest in Cryptocurrency

The cryptocurrency sector is still in a state of relative infancy. However, new cryptocurrencies are launching regularly and the industry has expanded to include non-fungible tokens (NFTs), utility tokens, stablecoins and more.

When deciding whether or not to invest in cryptocurrency, it’s important to consider your own risk tolerance. While cryptocurrencies may generate impressive returns, they also have the potential to lose value quickly.

If you are interested in investing in cryptocurrency, you should research the platform you’re considering. Look for who owns the marketplace and learn more about their history. It’s also helpful to see if other high profile investors are involved with the project.

If you’re unsure how to balance cryptocurrency in your investment portfolio, it’s worth talking with a financial advisor. SmartAsset’s free match tool can connect you with vetted financial advisors who serve your area. You can then interview your advisor matches at no cost to decide if they are a good fit for you.

What Crypto Coin Should I Invest in

Cryptocurrency is a speculative investment, and while it has many benefits, including being decentralized and secure, it can also be volatile. As such, it is important to understand the risk involved and determine if it is appropriate for your investing strategy.

This year has been a turbulent time for the crypto market, with crashing prices and high-profile collapses of companies in the space causing investors to lose faith. However, if you do your research and select coins that offer price stability and long-term profitability, you can still find value in this space. Some of the most promising cryptocurrencies to consider include Polygon, Polkadot, and MATIC. Each of these has its own unique advantages, and it is worth evaluating each to decide which would be the best fit for your portfolio.