As a long-term investment, cryptocurrency can be an excellent addition to your portfolio. However, it’s important to understand the risks and make sure that your crypto investments fit your risk appetite.

To start, look at a cryptocurrency’s price history. Also, check out the community and what kind of support it has.

Is crypto a good investment?

While it may be tempting to invest in crypto because of its potential to generate high returns, there are also many risks involved. For one, cryptocurrencies are not backed by hard assets or cash flow. This means that if the price goes down, you will lose money. Another risk is that some cryptocurrencies are not regulated. This makes them a less reliable investment than stocks or mutual funds.

Additionally, cryptocurrencies are not diversified, which could hurt your long-term investment goals. It is important to diversify your investments so that you can protect yourself from market downturns. A financial advisor can help you create an investment plan and manage your portfolio. SmartAsset’s free tool matches you with vetted advisors in your area. You can interview the advisor matches at no cost to decide if they are a good fit for you.

Despite the risks, some investors still believe in the potential of crypto as a new form of finance. However, it is important to understand the myriad of risks involved before making an investment. Cryptocurrency prices have been volatile, transactions are irreversible, and consumer protections are minimal or nonexistent. Additionally, hackers are a significant threat to cryptocurrency investments. These risks make it difficult for most investors to justify the risk.

Bitcoin halving price prediction

Bitcoin is a popular cryptocurrency that is highly volatile. This volatility could cause significant losses for investors who do not hedge their positions. It is also important to consider tax considerations when investing in crypto. High peaks mean that you have to pay capital gains taxes and dramatic falls can lead to large capital losses.

The bitcoin halving is an event that occurs every four years and reduces the number of coins miners receive per block mined. This helps keep the cryptocurrency scarce and valuable, which can support its price. However, it also means that mining rewards are cut in half, which may lead to lower demand for the coin.

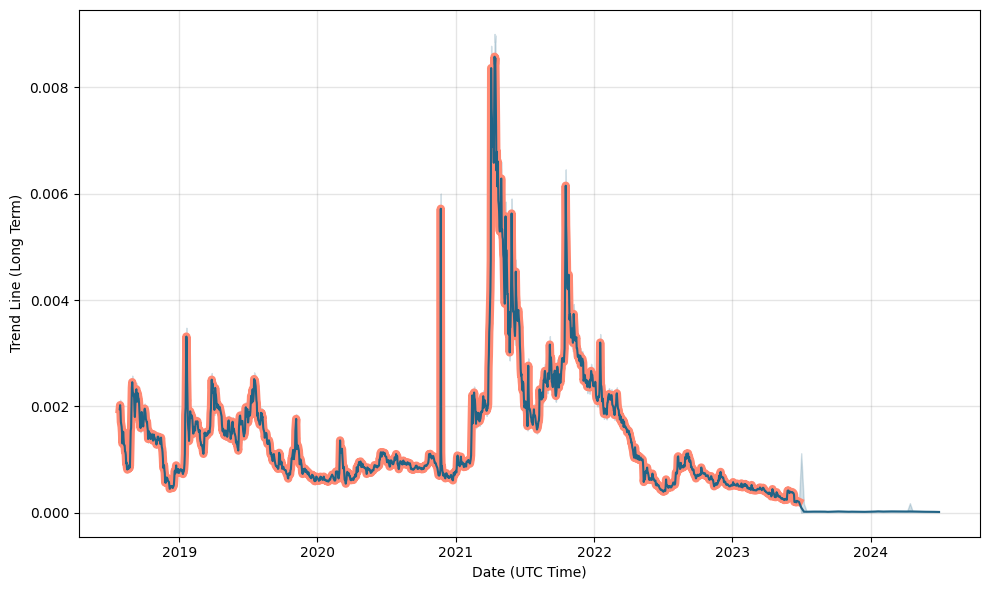

Crypto traders have been predicting the impact of the next halving on bitcoin prices. Renowned pseudonymous crypto trading expert PlanB claimed in October that the next halving would pump BTC. He based his prediction on the stock-to-flow (S2F) model, which has a strong track record of predicting price movements before and after halvings.

S2F takes into account the number of existing bitcoins in circulation as well as the rate at which they are being used. It also takes into account the amount of energy that is being consumed by the network. The model has been criticised by some for its inaccuracies, but it remains a popular tool among crypto investors.

Is crypto a long term investment?

Investing in crypto can yield tremendous returns, but it is important to understand what you’re investing in. There are many different kinds of cryptocurrencies, each with its own purpose. Some are designed to be a transactional currency like Bitcoin, while others represent voting or other rights on a blockchain. Still others are platforms that support applications on a blockchain, such as Uniswap. Investors should consider how each type of cryptocurrency fits into their portfolio and risk tolerance.

One big drawback of crypto is its high volatility. As a result, investors may experience losses, which can be devastating to their investment portfolios. Some people try to time their investments by buying during price dips. However, this strategy is dangerous and can lead to significant losses if the market reverses course.

The specific cryptos you choose also matter, says Feldman. Some have more promising long-term use cases and are less susceptible to price manipulation. In addition, it is a good idea to diversify your cryptos to reduce the risks of losing a large portion of your investment.

Finally, you should always store your coins in a secure place. It is recommended that you store your cryptos with an investment platform that is regulated and offers security features, such as multi-signature transactions.