A crypto trading bot removes emotion from the investing process and allows you to execute trades based on data instead of hunches or sentimentalities. However, it’s important to pick a reliable crypto trading bot that will not compromise your funds or account.

The best crypto trading bots use artificial intelligence and other smart technologies to collect big data in real-time to predict cryptocurrency prices. They then apply predefined trading strategies to amplify your profits.

Cryptocurrency Automated Trading Bot

There are a few different types of crypto trading bots. Technical trading bots use preconfigured technical indicators to identify opportunities and execute trades. These bots can be configured to trade intraday or over a longer time frame. Other crypto trading bots offer social trading, allowing you to copy the indicators of other traders. These bots can also help you to automate the process of rebalancing your portfolio.

Arbitrage trading bots take advantage of price differences between exchanges to generate profits. These bots can be used to exploit inefficiencies caused by the fact that each exchange has its own unique pricing model.

Cryptocurrency trading bots can be built using open source code or purchased from a platform like RevenueBOT. Many of these platforms are cloud based, making them convenient to use. However, there are also a few that require you to install the software on your own computer or server. These programs tend to be more customizable and often have better performance.

Which is the Best Crypto Coin to Invest?

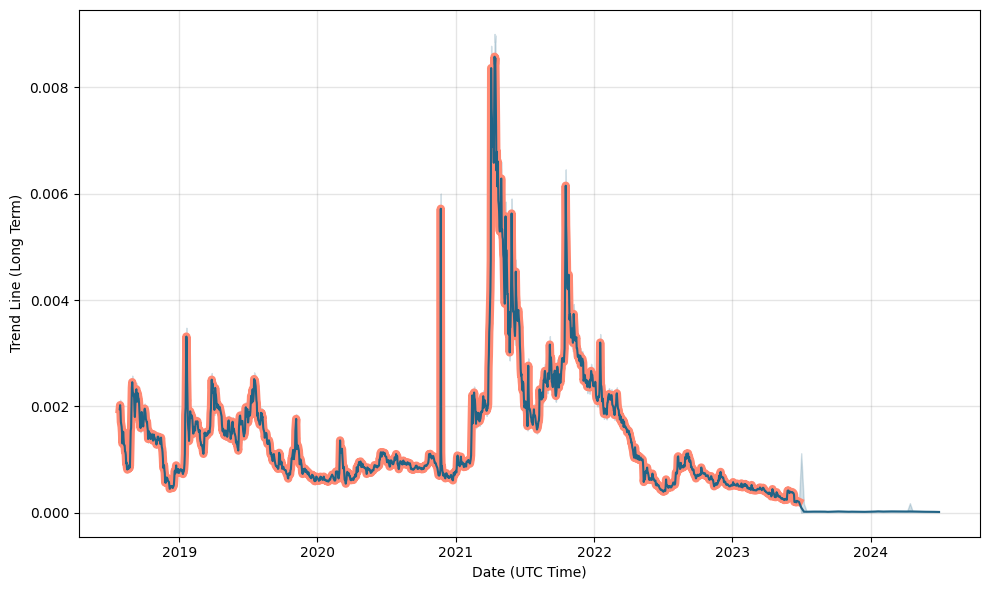

There is no definitive answer to this question as it depends on your investment goals. If you are looking for a short-term gain, it is important to find a coin with good liquidity and the potential for a quick price run-up. The best way to do this is to track the top market cap coins and look for opportunities to buy them when they reach a peak in value.

If you are looking for a longer-term investment, it is important to find a coin that has a solid team and roadmap. In addition, you should also consider the overall market capitalization of the coin. Larger market cap coins, such as Bitcoin, have a more limited upside than smaller, newer projects with significant potential for growth.

A great option for beginners is 3commas, which offers a range of trading bots that can be used to automate your crypto investments. They have a free plan that is perfect for beginner traders and also has advanced features like backtesting and social trading.

Is Usd Coin a Good Investment?

USD Coin is a stablecoin pegged to the US dollar. It is designed to trade as close to $1 as possible, and it’s backed by US dollars held in reserves at the Centre consortium (co-founded by Coinbase and Circle).

Stablecoins like USDC are a great way for investors to hedge against market volatility. They can be used to transfer value across blockchain networks without incurring any price fluctuations, and they can also be used to buy other cryptocurrencies on exchanges.

Another great feature of USD Coin is that it can be used to fund global crowdfunding projects. This means that startup companies and nonprofit organizations can raise money by selling USDC tokens to investors and donors worldwide. This is a great way for them to avoid the high fees associated with traditional fundraising methods.

Is UsdCrypto a Good Investment?

USDC is a fiat-backed stablecoin that is pegged 1:1 to the US dollar. It was created by the Centre Consortium and is audited on a regular basis to make sure that it stays valued at $1. This makes it a good investment because you can count on it to hold its value over time.

One of the best things about USDC is that it can be used to transfer money internationally. It’s a fast and cost-effective alternative to transferring funds via ACH or wire transfers. USDC can also be used to earn passive income by lending your USDC to other crypto investors.

There are many different types of crypto trading bots available on the market. One popular type is an arbitrage bot that looks for price discrepancies across exchanges. Another is a martingale bot that performs DCA buy, one-time sell to capture fluctuation profit. There are also rebalancing bots that help traders keep their portfolio balanced. Some bots use machine learning to improve their performance. Others use technical indicators to establish their trading strategies.