Using a trading bot can be a great way to save time and money. It can also help you improve your trading skills. However, it is important to know the risks involved in using a trading bot.

Cryptohopper is a 24/7 trading bot that uses exclusive cloud hosting for its services. It supports multiple exchanges and has a simple and intuitive setup process.

Site tells more about trading bots

Traders use trading bots to automate their repetitive tasks so that they can spend more time on research or other business activities. This way, they can make money and gain more control over their portfolios. These bots are usually based on algorithms that analyze market figures and make judgments that will result in a profit at the most optimal level.

Several different types of trading bots are available, including arbitrage bots and market-making bots. Arbitrage bots take advantage of price discrepancies between exchanges to generate profit. They are also known as order-matching bots. Another type of trading bot is a trend-following bot, which buys assets when prices increase and sells them when the price decreases.

There are various trading bots available online, but not all of them work the same. Some are cloud-based, while others require that you install them on your computer. To choose the right one for you, consider the features and pricing of the bots.

Bitcoin scalping bot

Traders who are looking to scalp the market can benefit from a crypto scalping bot. These bots will help traders keep track of the market, so they can make the most of price fluctuations. Moreover, they will take the emotion out of trading, so that traders can make more precise trades.

Quadency is one of the best options when it comes to scalping, and they also offer a mobile app that makes it easy for traders to make trades on the go. Their app is compatible with a variety of exchanges and offers support for trading more than 600 cryptocurrencies.

Bitsgap is another great option for those who want to use a scalping bot. It offers a variety of trading strategies and has a demo mode to test their performance. They also provide portfolio management and a secure API connection to the exchanges. They also offer a variety of order types, including shadow orders and market orders.

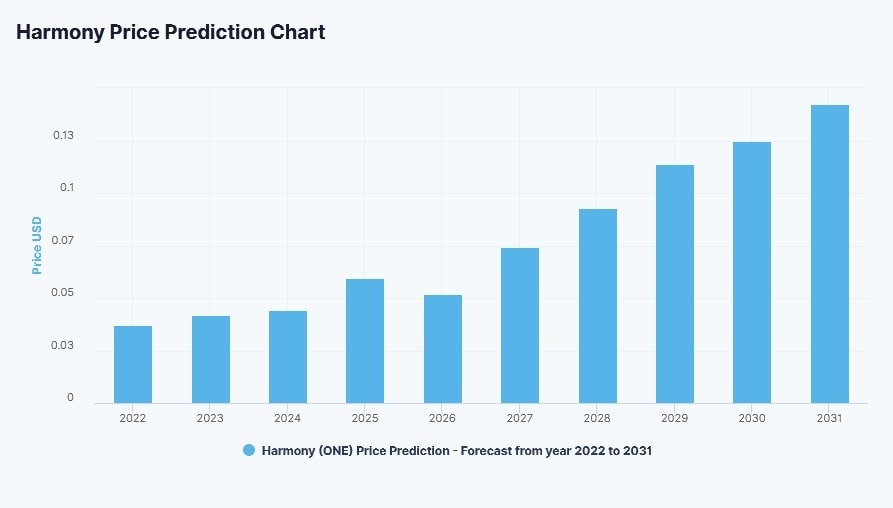

Iost cryptocurrency price prediction

The Iost cryptocurrency price prediction is an attempt to give investors a general idea of what the coin could be worth in one hour, tomorrow, over the next week and next month. These predictions are based on the analysis of technical indicators.

The IOST coin price surged immediately after its launch in January 2018. It started trading at $0.03748 on 18 January and reached a record high close of $0.1268. Then, it slipped to $0.02922 in early February.

It is important to remember that investing in cryptocurrencies is a highly personal endeavour, and there is no guarantee of any particular price movements. Many traders try to use candlestick patterns to predict future price action, but they should always be aware that this is a very risky way of making money. Some investors also watch the activities of “whales”, which are individuals and entities that control large amounts of crypto. These whales can single-handedly make or break a currency’s price.

Fantom crypto

Fantom crypto is a fast and inexpensive layer-1 blockchain that promises better scalability than Ethereum. It uses a bespoke consensus mechanism, Lachesis, to ensure security and two-second transaction finalization. The network is also compatible with EVM-based dApps, making it easy for developers to migrate their contracts.

The native token FTM is used for transactions, staking, and governance. The more tokens you stake, the higher your voting rights. This model is designed to encourage users and developers to take part in the community.

The platform provides everything needed to build scalable, fast, and inexpensive Web3 applications. It is EVM compatible and supports a large library of dApps. Fantom’s scalability comes from its proof-of-stake system, in which transaction verification is done by nodes consisting of people holding FTM. These nodes confirm transactions in batches and then assemble them into final blocks. This allows for faster confirmation times than traditional proof-of-work blockchains. It also puts security first, preventing Sybil attacks and verifying transactions in a trustless environment.