Cryptos are risky investments and can fluctuate in value, sometimes by large amounts within a short time period. They also don’t produce a return in the way stocks or cash do, so you need to be prepared to lose your investment.

You should diversify your portfolio by investing in a number of different cryptocurrencies. This will help you minimize your risk.

What crypto coin should i invest in?

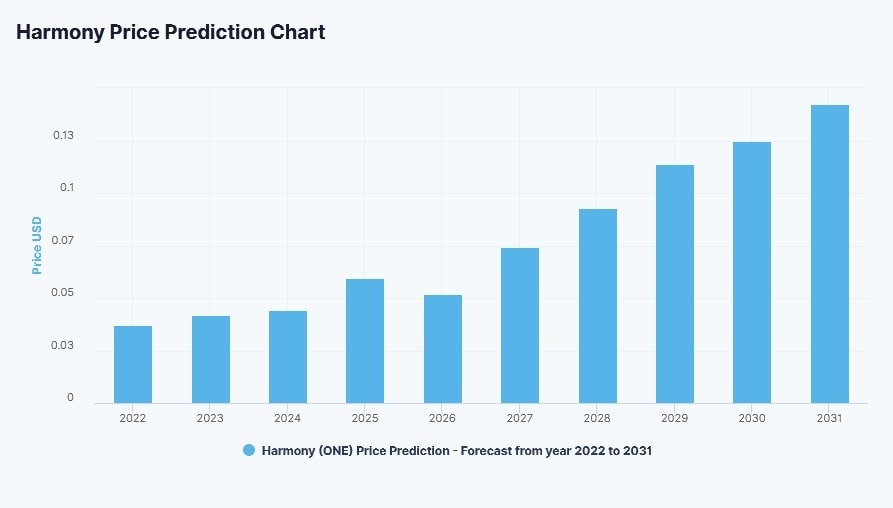

There are many different cryptocurrency coins to invest in, and the best one depends on your investment goals. If you are looking to invest in the long term, consider investing in a coin that has a good track record and a solid technical analysis. If you want to invest in the short term, look for a coin that has strong circulating volume and good projections for the future. Some good penny cryptos to consider include VeChain, Stellar, Basic Attention Token, Chilliz token, Dogecoin, and Zilliqa. Each of these coins is under a dollar and has huge potential. However, remember that cryptocurrencies are highly volatile and should be considered risky investments.

Trader bot bitcoin

Trader bots are software programs that interact with crypto trading exchanges to place buy and sell orders on your behalf. They use an algorithm to analyze market data and predict how prices will move in the future. This is a great tool for traders and investors who want to automate their portfolio.

However, if you’re not familiar with the market or don’t have the programming skills to create your own strategy, a trader bot may not be the right investment for you. They require constant monitoring and may not be helpful during periods of high volatility.

The best trading bots have a variety of features, including support for multiple exchanges and the ability to create custom trading strategies. They also offer automated risk management and alerts to help you keep track of your profits. They’re also able to detect and prevent overtrading, which can lead to significant losses. A good trading bot should also allow you to backtest your strategy to see how it performs.

What cryptocurrency to invest in?

Cryptocurrency is a hot investment option, but it’s important to research the various options before investing. You should also consider the risk and return potential of each cryptocurrency before making a decision. For example, a cryptocurrency with low market share may not perform as well as one with high adoption.

Another consideration is whether a cryptocurrency has a stable price. You can find this information by looking at the cryptocurrency’s past performance. For instance, if the cryptocurrency has had a steady price increase for years, this is a good sign.

Cryptocurrencies are an intriguing investment option, but they’re volatile and don’t provide the same level of security as traditional investments. As a result, they should be considered as speculative assets and a part of a diversified long-term portfolio. If you’re interested in learning more about cryptocurrency, talk to a financial advisor. SmartAsset’s free tool matches you with up to three vetted advisors in your area, and you can interview them at no cost to decide which is right for you.

How to invest in crypto?

Cryptocurrencies, also known as cryptos, are a hot investment right now. But before you invest, it’s important to understand what crypto is and the risks involved. Also, it’s important to keep up with news about cryptos to make informed decisions. News sources like Twitter, Telegram, Facebook and cable news are good places to start.

It’s also important to diversify your investments. There are thousands of different cryptocurrencies to choose from, and some have much more potential for long-term growth than others. When choosing a cryptocurrency to invest in, read its white paper and road map to see what it’s trying to accomplish. Also, look for a cryptocurrency with a high level of adoption. This will increase its value and liquidity. Finally, look for a coin with strong community support. This will help it weather any price volatility and give you a better chance of making money. As with all investing, it’s important to consider your tolerance for risk (both financial and psychological) and time horizon before making a decision.