Cryptocurrencies aren’t backed by any government or central bank and their value is volatile. Investors need to understand how they fit into their portfolios and what risk they can handle.

Despite the popularity of cryptos like Bitcoin, Ethereum and Dogecoin, many financial professionals don’t recommend investing in them. Instead, they suggest building a solid investment plan that can help you reach your goals without putting your life savings on the line.

Top 5 cryptos to invest in

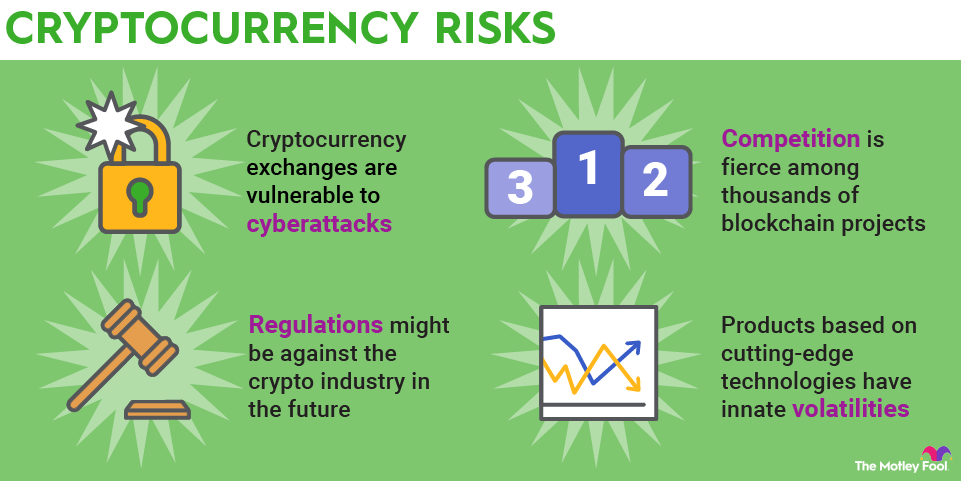

Cryptocurrencies are a hot investment right now, but they’re also very volatile. That’s why you should invest in crypto only if you can handle the risks.

One of the main reasons to invest in a cryptocurrency is because it has a lot of potential for growth over the long term. However, it’s important to understand that not all cryptocurrencies are created equal.

You should consider whether the team behind the project is qualified, as well as their technology and development. The community around the project is crucial, too.

In addition to this, the project should have a strong roadmap with real-world applications. This will help you decide if it’s worth investing in.

Another reason to invest in a cryptocurrency is because it aims to revolutionize the way we interact with the digital world. This is especially true for projects that utilize Metaverses and NFTs.

Securedverse is a blockchain-based gaming platform that offers an immersive gaming experience and a chance to earn a passive income through staking. The project is backed by the NFT community and celebrities, and it has an established team with strong expertise in the industry.

Is shiba inu a good investment for long-term

When it comes to long-term investing, it’s important to consider your goals and risk tolerance. You should also evaluate your financial situation before deciding whether or not to invest in crypto.

Shiba Inu is a community-run cryptocurrency project that’s building an ecosystem with its own DEX, P2E games, and a metaverse. It’s a good investment for crypto enthusiasts and long-term investors who are looking for a way to diversify their portfolio.

However, there are a few key factors that you should keep in mind when evaluating whether or not to invest in shiba inu. These factors include its tokenomics, price volatility, and market capitalization.

Its tokenomics are key to its success, as its supply is relatively low compared to other cryptocurrencies. This will allow the price to fluctuate based on new issuance and inflation.

Moreover, the Shiba Inu network is also compatible with Ethereum wallets, making it easier for users to use. It has also launched a decentralized exchange called Uniswap that allows users to buy and sell tokens without an intermediary.

The Shiba Inu team also burns 50% of the tokens in circulation every six months, which has helped reduce the supply to just over a quadrillion. This makes it a very liquid coin, even in a weak market.

How much to invest in cryptocurrency

Cryptocurrency is a volatile asset, but it can be a great way to build up your wealth over time. However, there are a few things to consider before you jump in.

The first thing to consider is your own financial situation and risk tolerance level. A good rule of thumb is to allocate no more than 10% of your portfolio to high-risk assets, such as cryptocurrencies.

A key part of investing in a new asset is learning as much as you can about it. This includes reading about the company’s history, roadmap, whitepaper, social media channels, and exchanges that it’s listed on.

Another important consideration is timing. Cryptocurrency markets are often subject to repeated market cycles, which can create BIG bubbles.

During these times, it’s critical to take action and buy or sell crypto at the right moment. If you do this correctly, you can earn a lot of cash very quickly. It’s also a good idea to diversify your investments, so that you don’t lose everything when one asset goes down.