A free trade bot for bitcoin is a useful tool for traders who want to make their trading process faster and more efficient. These tools automate repetitive tasks and help traders monitor market figures in real time.

There are many crypto trading bots out there, and it can be difficult to know which one is best for you. Here are a few of the most popular options:

Site that allows you to build cryptocurrency bot

A crypto trading bot is a computer program or application that trades cryptocurrency on your behalf. These apps often use pre-programmed rules to trade based on market markers and tendencies.

They can be a great help in volatile markets, such as the crypto market. This is because they are immune to rash decisions, such as panic and selling.

The first step in building a crypto bot is to select the type of trading strategy that you want it to employ. Also, consider the algorithm that it will use to analyze data.

Once you’ve selected the algorithm, it is time to code your bot. This will include a discussion with a development team about your expectations and what technology you want to use.

Another crucial part of the process is testing. This is where you can make sure that your bot works correctly and isn’t crashing.

Finally, you’ll need to choose a programming language that is widely supported and has a thriving bitcoin ecosystem. This will ensure that it’s easy to scale, adapt and add as needed.

A good company will offer a post-development support system that ensures that your bot is working seamlessly. They’ll also give you the chance to test it with historical data before deploying it.

What is bitcoin sv price prediction

Bitcoin SV price prediction is the process of identifying the direction that the BSV market is likely to take next. This can be done through a number of tools, including indicators and chart patterns.

Some of the most popular Bitcoin SV price prediction tools include moving averages, RSI and Fibonacci retracement levels. These tools can help you identify important support and resistance levels, which can indicate when a market trend is likely to stall or reverse.

A number of other factors can also affect the Bitcoin SV price, including competition among cryptocurrencies, block reward halvings and new protocol updates. These events can lead to volatility in the BSV market and can make it harder to predict its future direction.

As a result, there is no one single Bitcoin SV price prediction for the short term. It is important to remember that the price of any crypto can change drastically in a short period of time, so it is important to do your own research before investing.

Many experts have made their own Bitcoin SV price predictions, with some of them being very bearish on the coin in the short term and others being very bullish on it in the long term. For example, Wallet Investor is quite heavily bearish on the coin in the short term, predicting it to fall by more than 25% to $65. However, Digital Coin Price is much more optimistic and believes that it could reach $400 sometime in the future.

Sanshu inu coin price prediction

Cryptocurrencies are rapidly gaining popularity with investors across the globe. They are becoming a safe and convenient way to transfer money, store value and trade with others.

There are a number of different bots that you can use to help you make the most of your investment in cryptocurrencies. These include DCA (Dollar Cost Averaging) bots and rebalancing bots.

A DCA bot will buy a certain amount of a cryptocurrency for every dip, which allows you to build up your portfolio with less capital. It also helps you avoid overextending your funds and can be a good choice for beginners.

Many bots are available for free, but you can also purchase one if you’re interested in a more advanced version of the tool. For instance, you can get a bot that uses an oscillator to predict short-term overbought and oversold conditions.

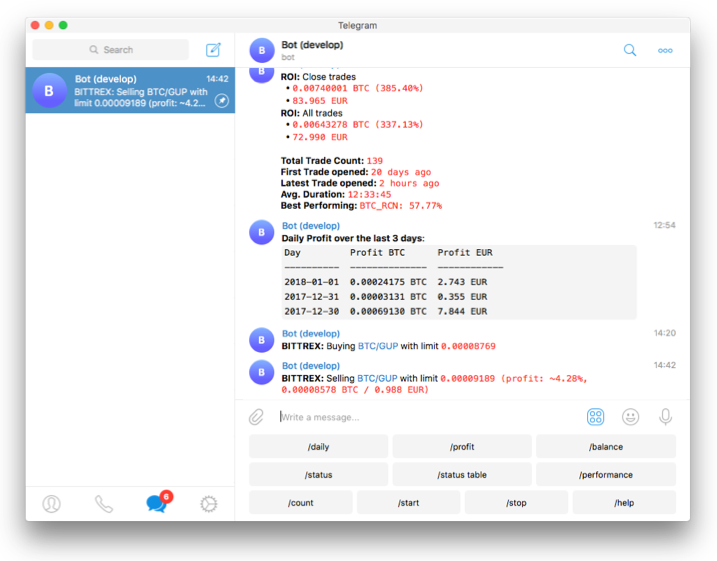

Another popular option is to build a trading bot that automatically executes limit orders when prices reach specific levels. You can then set the risk tolerance of the bot, and how aggressive you want to be with your limit orders.

There are a number of sites that allow you to build your own cryptocurrency bot. However, you should do your research and choose a site that has a solid reputation for delivering high-quality projects on time.