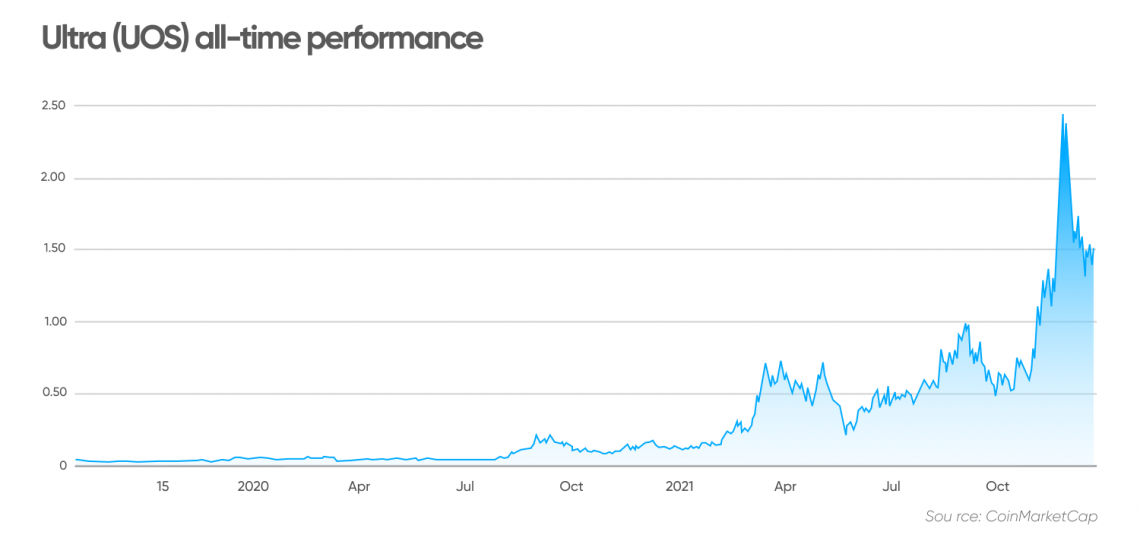

When making a ultra coin price prediction, traders often use moving averages to identify resistance and support levels. If the price moves above or below these averages, it’s considered bullish or bearish respectively.

Unlike Steam, which is a monopoly in the gaming industry, Ultra promises more equity for video game players, developers and influencers. It also offers a number of features that distinguish it from competitors.

Emax

Crypto market is highly volatile, making it hard to predict EMAX price. Besides, there are many other factors that affect the price of a coin or token. This is why it is important to do your own research before investing in a cryptocurrency.

EMAX was in the news after celebrities Kim Kardashian and Floyd Mayweather promoted it on social media. However, the cryptocurrency has fallen since then. Its price has been trending downwards since the beginning of this year and is down 77% year-to-date.

Traders are also monitoring the activities of EMAX “whales”, which are individuals or entities that control large amounts of the coin and influence its price. They are looking for candlestick patterns that indicate bullish or bearish momentum, as well as technical indicators such as RSI and MACD. These charts can be viewed with different granularity, including 1-hour, 4-hour, and weekly. These charts are used to identify patterns that can be profitable for short-term trading.

NEM

NEM is a cryptocurrency and blockchain platform, which means it’s both a currency and a technology. Like other popular cryptocurrencies, NEM has some lofty goals and promises to change the world for the better. However, investors are growing more and more skeptical about the technology’s real potential to succeed in achieving these goals.

The price of NEM has been steadily climbing over the past year. However, its value has not yet reached a high point. Investors should take this into account when making their investment decisions. It’s also important to remember that a crypto market can be volatile and that NEM is not guaranteed to increase in value.

Many different factors influence the price of NEM, including block reward halvings, hard forks, and protocol updates. These events can dramatically change the value of NEM and should be considered when evaluating your investment. In addition, there are several technical indicators that can help you predict the price of NEM. These include moving averages, RSI, and Fibonacci retracement levels.

Ergo

Ergo is a programmable blockchain that is backed by a robust, decentralized ecosystem. It offers a number of useful features, including a smart contract language that supports various types of transactions. It also has the potential to be used for global digital peer-to-peer payments.

The team behind Ergo has extensive experience in the cryptocurrency industry. Co-founder Alexander Chepurnoy was a core developer on the Nxt platform, and Dmitry Meshkov worked at IOHK, an engineering and research firm that was instrumental in developing Cardano. The team’s slow and steady development approach is a reflection of its focus on rigorous research before code implementation.

Despite these positives, the crypto market is extremely volatile and no cryptocurrency is a sure thing. Investors should therefore be cautious when buying Ergo and only invest money they can afford to lose. In addition, Ergo has not been listed on major exchanges, which may hinder its growth potential. Nevertheless, experts have a positive view of the crypto’s future and expect its price to rise in the near future.

Ultra

Ultra is a cryptocurrency that is gaining popularity among gamers and developers. It uses a customised version of the EOS blockchain to create an all-in-one PC game distribution platform. Its unique features include proof of ownership and transaction transparency, as well as financial incentives for players.

The price of Ultra is influenced by the market sentiment and the performance of other cryptos. In addition, it is also affected by the activity of UOS “whales”, who are individuals or groups that control a large amount of the token. Many traders use candlestick charts to identify these patterns.

Another method of predicting the price of Ultra is to look at its correlations with other cryptocurrencies. For example, it is positively correlated with the top 10 coins by market cap, and negatively correlated with stablecoins. This information can help traders determine the potential direction of the price. Traders can also use moving averages to identify trends. These are based on the average closing price over a certain period, divided by a specific number of periods.